aurora co sales tax rate 2021

The December 2020 total local sales tax rate was 8350. They will be stored in Aurora and shipped to various stores in and out of Aurora as needed.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125.

. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. Aurora co sales tax 2021. Boulder CO Sales Tax Rate.

Depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county. The current total local sales tax rate in Aurora OR is 0000. Updated 12021 Effective July 1 2006 the Scientific and Cultural facilities District CD of 010 consists of all areas within Arapahoe County Effective December 31 2011 the Football District.

The vendor did not charge XYZ Aurora sales tax. Average Sales Tax With Local. Effective July 1 2022.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. The December 2020 total local sales tax rate was also 0000. Residential Property Tax Rate for Aurora from 2018 to 2021.

This is the total of state county and city sales tax rates. This sales tax will be remitted as part of your regular city of Aurora sales and use tax. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account. Broomfield CO Sales Tax Rate. Aurora OR Sales Tax Rate.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Ad Lookup Sales Tax Rates For Free. The current total local sales tax rate in Aurora MO is 8850.

Method to calculate Aurora sales tax in 2021. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300. The County sales tax.

The Colorado sales tax rate is currently. You can print a 85 sales tax table here. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Castle Rock CO Sales Tax. The colorado co state sales tax rate is currently 29. Monthly if taxable sales are 96000 or more.

This is the total of state county and city sales tax rates. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Since the retailers sales in colorado in the current year exceed 100000 the retailer will be.

The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. Aurora MO Sales Tax Rate. Brighton CO Sales Tax Rate.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Aurora CO Sales Tax Rate.

XYZ must pay 375 percent Aurora use tax on all. Residential Property Tax Rate for Aurora from 2018 to 2021.

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

2020 Town Sales Tax Reports Show Slight Increases In Overall Business Revenue Summitdaily Com

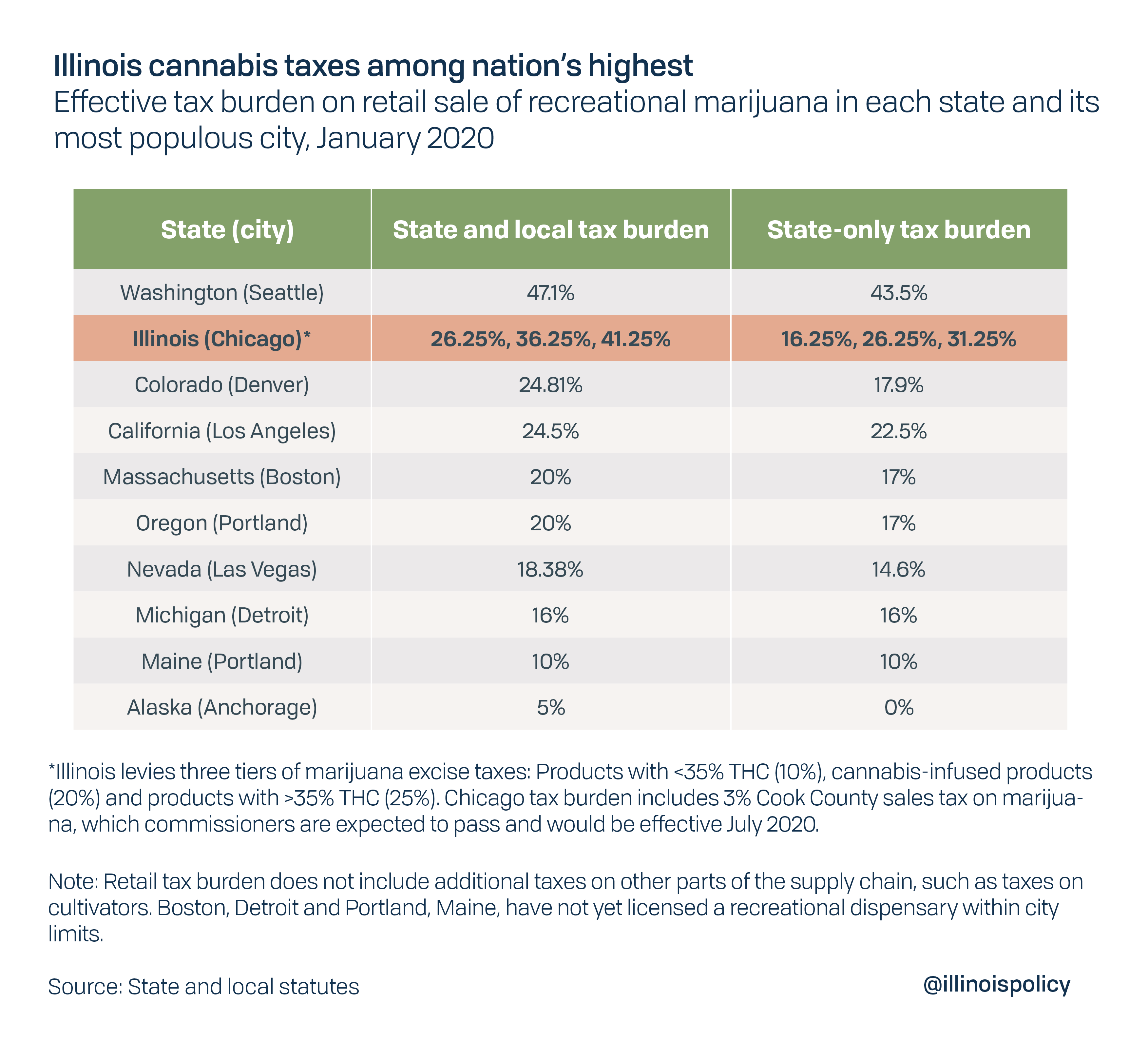

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

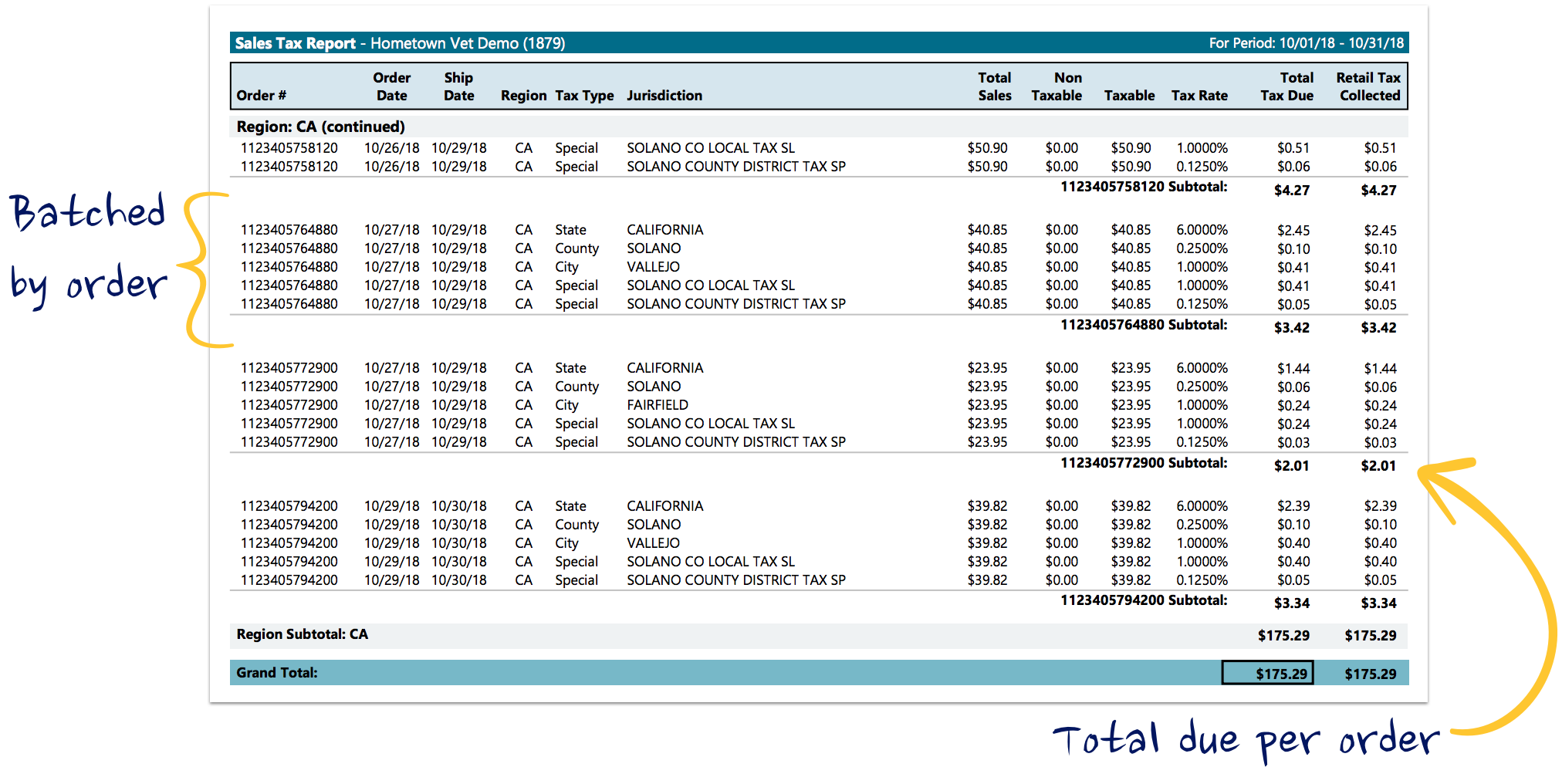

How To File And Pay Sales Tax In Colorado Taxvalet

2021 Election Results Conservative Candidates Winning In Aurora City Council Contests But Not In School Board Races Sentinel Colorado

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora Highlands Residents Have No Vote Little Voice All The Debt Business Gazette Com

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Colorado Income Tax Calculator Smartasset

What Would The Tax Rate Be Under A National Retail Sales Tax Tax Policy Center

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Winter Park With Highest Sales Tax Rate In The State And Fraser See Increases In Sales Tax Revenue Skyhinews Com

Ohio Sales Tax Rates By City County 2022

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan